Is your organization mature enough for Industry 4.0?

The concept of digital transformation is vaguely defined by industrial enterprises in various segments. For a research report published in December 2022, we asked early adopters of private wireless and industrial edge to tell us what stage they were at in their digital transformation journey. Close to 80 percent of them believed they were at least 51 percent of the way to their goals, while 30 percent believed they were between 76 percent and 100 percent.

We were happy to learn that private wireless and industrial edge had accelerated their progress with Industry 4.0 and digital transformation. On the other hand, we were concerned they would stop or stall, fall behind their competitors and miss out on the growth window for their businesses and operations.

These concerns motivated us to conduct some further research to find out how industrial enterprises were progressing with technology adoption and understand how well their IT and operational technology (OT) teams were aligned. We partnered with ABI Research to survey 500 IT, OT and management leaders working for industrial enterprises in the chemicals, electronics and appliances, fabricated metals, mining, petroleum, and ports and logistics segments. The enterprises are based in France, Japan, Germany, the United Kingdom and the United States.

All respondents were involved in devising the overall strategy, program design, or on-site implementation of digital transformation projects at their industrial facilities. We designed the survey to gain insights into their operational concerns, the background for their investments and their barriers to adoption.

The biggest concern: IT and OT misalignment

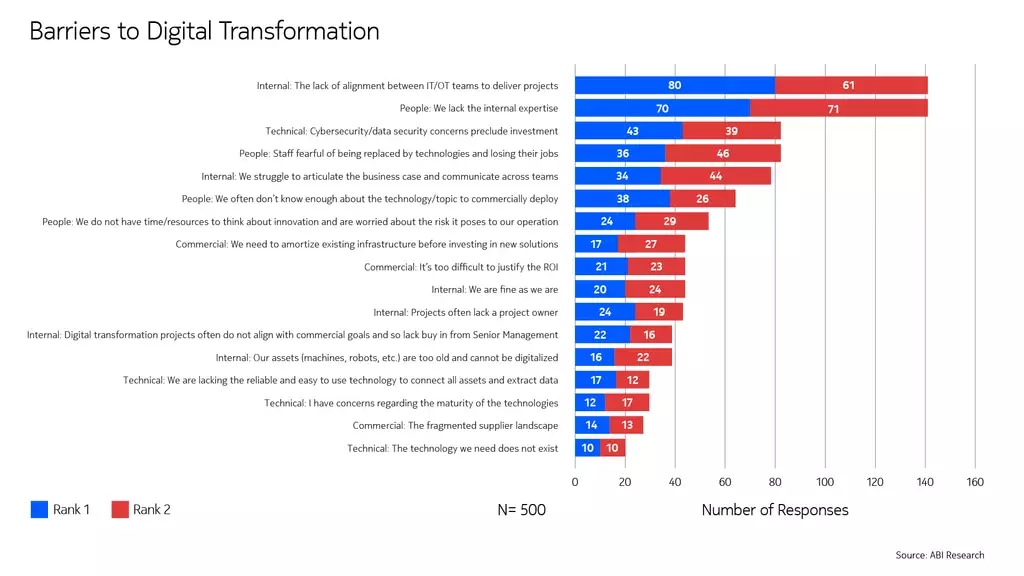

The survey asked respondents to rank their barriers to investing in and delivering on digital transformation projects. As shown in the chart below, the five most common barriers are mostly internal- and people-related, with a lack of alignment between IT and OT teams and a lack of internal expertise topping the list. One of the secondary concerns is that staff fear being replaced by technologies and losing their jobs, which aligns with the findings of our recent interviews with decision makers in the chemical manufacturing industry.

IT investments and plans

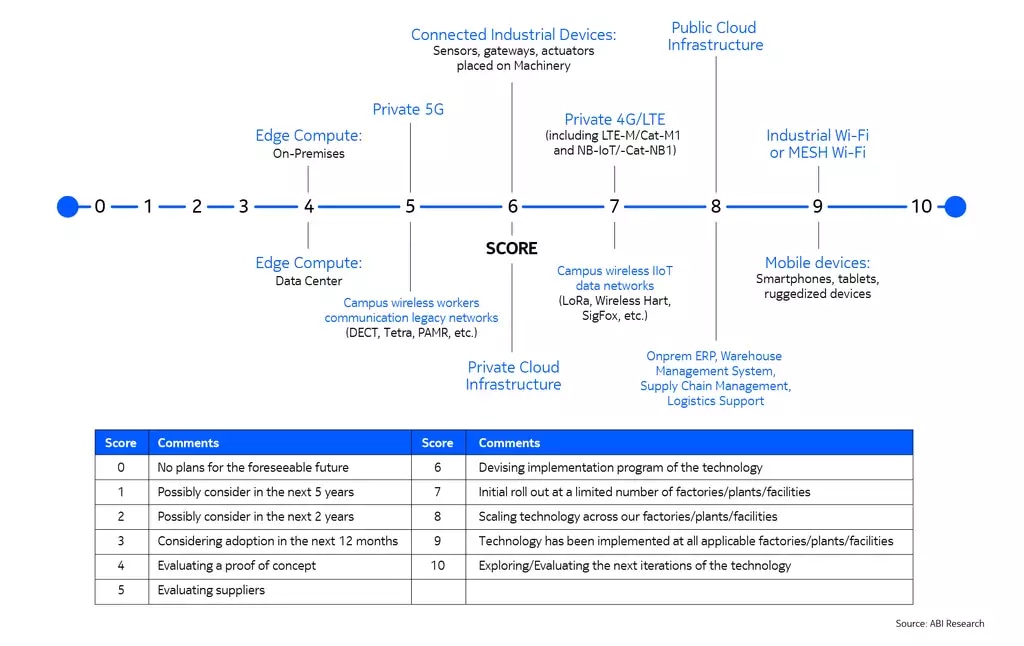

Our survey also asked respondents to share the progress they had made with IT infrastructure investments such as industrial Wi-Fi, private wireless, campus networks, devices, edge compute and cloud. The chart below shows the median scores for each IT investment area.

It is no surprise to anyone that all verticals have been rolling out industrial Wi-Fi to connect assets and mobile devices to support workforce communications. When it comes to private wireless, electronics and appliance manufacturers and fabricated metals producers lead the way in private 5G network deployments, with a median score of 6. The petroleum industry is ahead of the pack in scaling private 4G networks across their facilities, with a median score of 8.

Edge compute provides enhanced capability for automation and low-latency compute power for robotics. But many industrial enterprises are only now considering proofs of concept (PoC) for edge compute, aside from the electronics and appliances, which has a median score of 5. Considering that many respondents say they have yet to connect their equipment and assets to the internet, it is reasonable that they are at the PoC stage.

OT and use case deployments

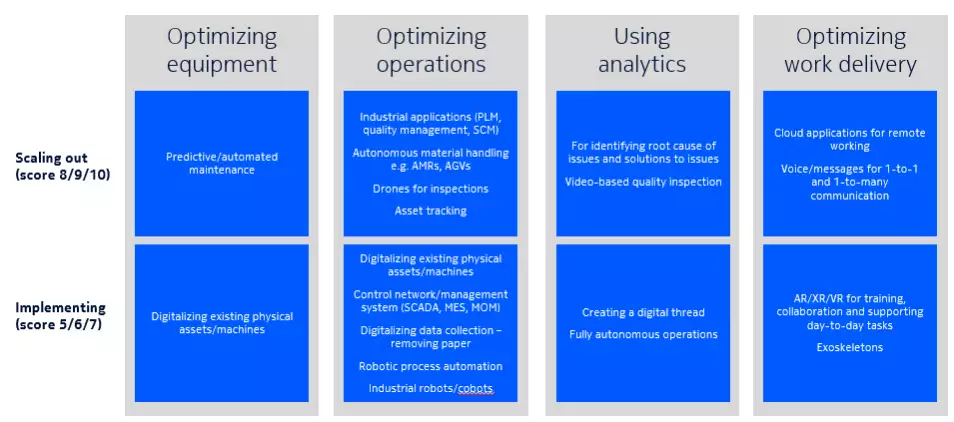

In the OT environment, the survey asked respondents to discuss their progress with use cases relating to equipment and asset performance improvement, production and operation optimization, data analytics usage and worker collaboration. As shown in the figure below, all of these use cases are at least under consideration in the next two years. The top priority for most enterprises is to optimize their workforces and operations.

For example, the electronics and appliance manufacturing vertical is very mature in digitizing its equipment and optimizing workforce performance and safety. Enterprises in this vertical have also made proactive investments in edge compute and private 5G. The maturity of the industry’s technology deployments allows enterprises to deploy advanced use cases such as autonomous guided vehicles (AGVs), automated mobile robots (AMRs) and augmented, virtual and extended reality (AR/VR/XR) can be deployed in a more timely and effective way to support business growth and operational efficiency.

The Industry 4.0 maturity index

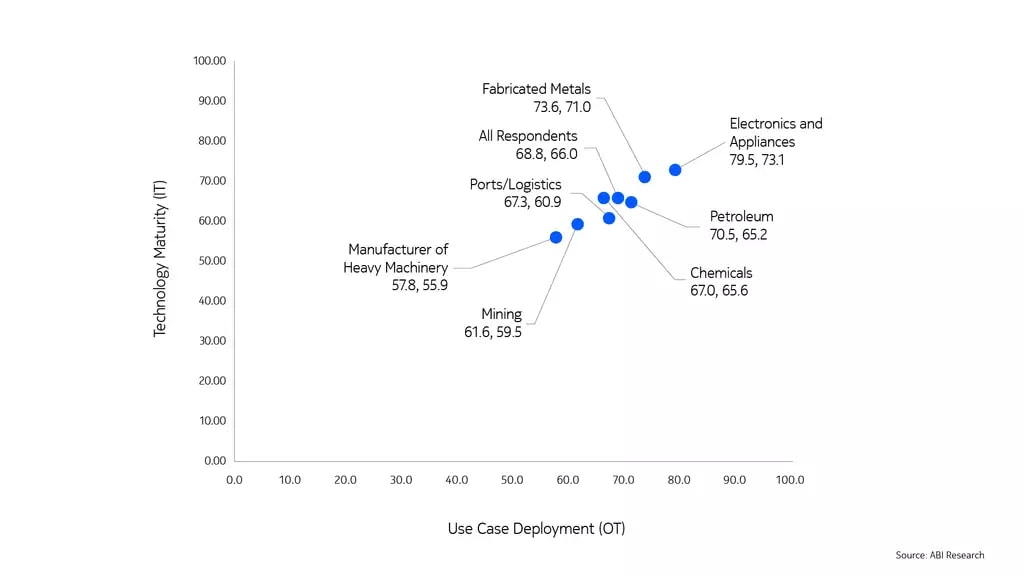

Nokia and ABI Research co-designed the Industry 4.0 maturity index to help industrial enterprises understand and benchmark their progress on the path toward digitalization and the industrial metaverse. Of the seven verticals we studied, electronics and appliance manufacturers lead the way in both technology maturity (73.1 out of 100) and use case deployments (79.5 out of 100).

Most of the verticals we studied have generally good alignment between IT and OT teams. Although electronics and appliance manufacturers are the most advanced, especially in their deployments in AGVs/AMRs, digitizing assets, private 5G and edge compute, they are also the most concerned about IT and OT misalignment. Their concerns about lagging behind their competitors and losing business and revenues drives them to keep innovating, reinventing and adopting new technologies to stay competitive.

Read our white paper for more insights about Industry 4.0 maturity in other verticals.

What does this mean for you?

Assess your Industry 4.0 maturity

The first step towards innovation and change is to understand your readiness for digital transformation. Use our assessment tool to get your Industry 4.0 Maturity Index score and discover key insights that can help guide your next steps towards digital transformation.

Accelerate wireless technology adoption

While industrial Wi-Fi serves great purposes in connecting industrial assets and providing basic connectivity for communications, it has fundamental shortcomings in coverage, latency, security and reliability, all of which hinder digital transformation. Private wireless has no such drawbacks and trumps industrial Wi-Fi when it comes to automating machines or mobilizing robots such as AGVs and AMRs. To offer enhanced capabilities such as low latency and real-time analytics, you must consider adopting edge compute.